Challenges in Content Delivery & Monetization for OTT

Over-the-top broadcasting (OTT) has become an industry norm. In short order, the emergence of internet-enabled “smart” devices, from phones to watches to TVs and laptops, has made cordcutting the new consumer paradigm. Conservative projections are for this to be a $40 billion global market before the end of 2020 (TDG Research Study).

By 2022 the number of active OTT video subscribers in the US alone will be nearly 200 million (eMarketer).

One consequence of this exponential expansion is a convergence of technologies and markets between OTT concerns and core telecom service providers. Equipment, methodologies and expertise in the delivery of digitized information to large and diverse audiences in different geographies, with varied requirements and restrictions has traditionally been the purview of telecoms. Partnering high volumes of in-demand digital content with the infrastructure and experience of seasoned telecommunications operations is proving to be fertile ground for OTT to flourish.

Despite these opportunities and the potential of the market, OTT is still faced with significant challenges. Digital video is a complex and demanding technical environment.

Enterprises hoping to establish an OTT presence are very often dissuaded by the expense and technology requirements.

1) Complexity and cost of infrastructure for building their platform

Based on our experience, building an OTT infrastructure takes approximately 6 to 10+ months – a slow, complicated and expensive process. It requires purchase of Aspera or Signiant licenses, servers and hardware encoders for initial onboarding, which are then idled between weekly or monthly content updates. Multiple encryption schemes, DRM key servers and client integrations are needed to enable Digital Rights Management. A single video must be transcoded and stored as multiple renditions to reach all consumer devices.

Content Delivery Network (CDN) partners must be onboarded and integrated with encoding workflows, along with optimization of caching and video delivery for OTT delivery. Online Video Platform (OVP) partners have to be engaged along with plug-ins and personalization to build custom workflows and define metadata schemas. Third-party vendors must then be sourced for integrating APIs with OVP partners and apps, and for assimilating workflows with monetization, content management and user management partners. Development teams are required to aggregate viewing logs from multiple sources and formats to write custom reports. To make matters more complex, a separate workflow is created for clip selection, encoding and syndication.

2) Maximizing revenue and boosting the value of video assets

With the extensive availability of internet, the increase in OTT subscriptions and viewership is creating unprecedented opportunities, forcing content providers to strategize outside the box for sustainable ways of monetizing their OTT content. OTT providers are delving into various revenue models to achieve profitability.

As consumers move away from traditional cable boxes, ad budgets from both digital and linear are sure to follow. As a result, OTT providers need to incorporate multiple monetization options like advertising, subscriptions and freemium options to obtain bigger shares of the revenue pie.

3) Reaching a global target market with a low churn rate

With the OTT Market expanding across the globe – including into developing markets – many service providers have decided to develop and reach these global audiences. And along with this growth and maturity, online streaming platforms are now in hard-pressed combat to secure digital audiences.

According to an analysis by PYMNTS.com, top reasons customers choose to abandon streaming services include too many ads (27%), service cost (25%), the lack of good content (20%) and technical problems (17%). Churn management is imperative because after spending significant capital on developing platforms and strategies to acquire subscribers, retention is required for the financial payoff. In addition to customer acquisition, content owners must develop effective customer retention strategies if they want to survive.

Expanding into international markets is expedient, but content owners must plan for the cost of retention in addition to the acquisition and infrastructure costs.

4) Providing multi-device viewing

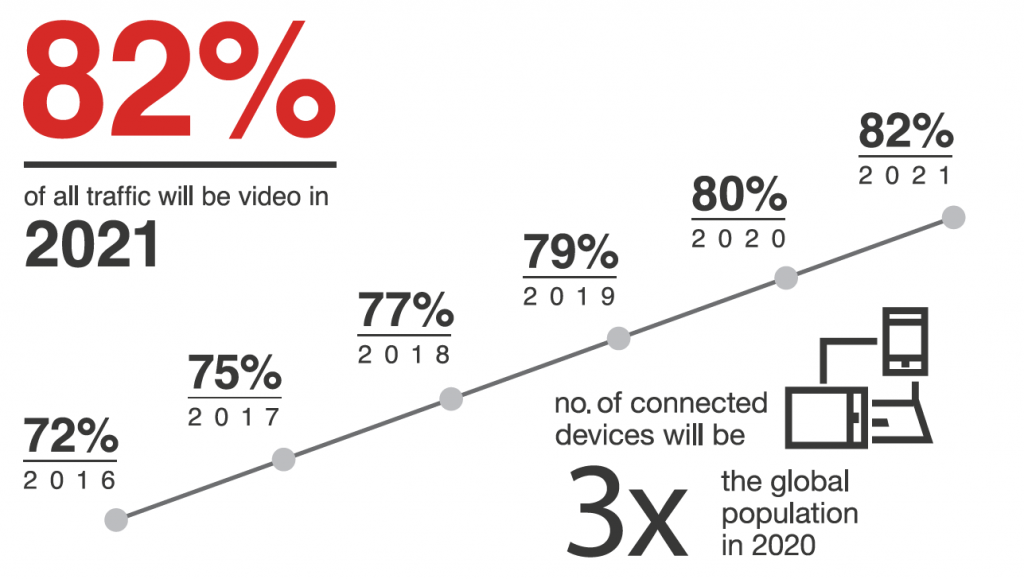

OTT platforms have increased in popularity because they provide not only on-demand access but also cater to a personalized viewing experience. Video content has gone beyond television screens with ever-increasing availability across multiple new screens including mobile devices, laptops and Smart TVs. Involving a huge investment in app development and video delivery, building multi-screen OTT video platforms can be demanding.

Today’s successful video content offering requires a multi-platform framework supporting VOD across a variety of OTT devices, personalization, continuous service evolution, a premium CDN for high-quality delivery, and video analytics to monitor performance and support real-time decision-making.

In short, when in control of their video platform, a service provider begins to own the market, the loyalty of audience and the data. Lacking that control can limit the opportunity to build revenue. In the current OTT ecosystem, service providers are seemingly left with no other option than to rope in different vendors for various functions like content management, app development and integration of the app with the content, etc.